Outboard Engines 2025-2030: How a Quiet Revolution Is Reshaping Yachting

A Transformative Decade for Marine Propulsion

As 2026 unfolds, the global outboard engine sector is entering the most transformative phase in its history, and the implications for yacht owners, builders, and investors are profound. What was once a purely mechanical, fuel-driven workhorse has evolved into a digitally integrated, increasingly electrified and sustainability-focused propulsion ecosystem. Across luxury yacht tenders, high-performance recreational craft, professional fishing fleets, and coastal commercial vessels, outboard engines now sit at the center of strategic decisions about design, cruising capability, total cost of ownership, and environmental impact. For the international readership of Yacht-Review.com, this evolution is not an abstract industry trend but a practical reality shaping purchase decisions, refit strategies, and long-term fleet planning from North America and Europe to Asia-Pacific, the Middle East, and Africa.

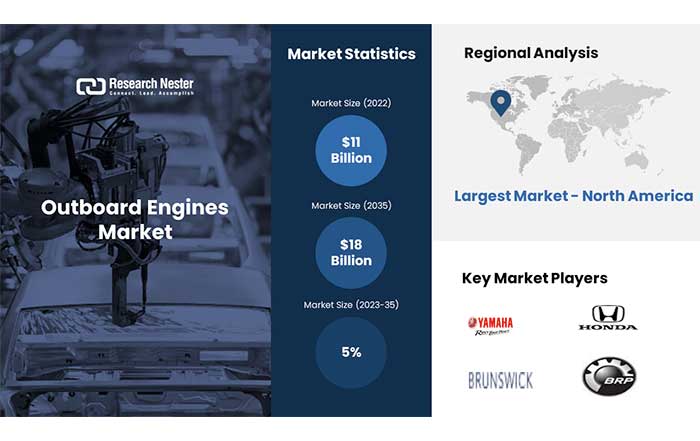

By 2025 the global outboard engine market had surpassed eleven billion U.S. dollars in annual value, and it continues to grow at an estimated compound rate of about five percent through 2030, driven by rising participation in recreational boating, the spread of marina infrastructure, and rapid advances in both high-power internal combustion engines and electric propulsion. While combustion engines still dominate volumes, electric and hybrid outboards are steadily capturing share each year as regulatory standards tighten and owners seek quieter, cleaner, and more refined propulsion solutions. For those tracking the latest models and comparative tests in the boats and reviews sections of Yacht-Review.com, propulsion choices are becoming as central to the ownership experience as hull design, interior layout, or onboard technology.

Global Market Dynamics and Growth Drivers

The structural drivers behind this transformation are diverse but mutually reinforcing. Leisure boating participation continues to expand in North America, Europe, and Asia-Pacific, supported by higher disposable incomes, post-pandemic lifestyle shifts toward outdoor recreation, and government-backed coastal tourism initiatives. In the United States and Canada, the well-established boating culture is being rejuvenated by younger owners attracted to intuitive digital controls, connectivity, and lower maintenance requirements. In Europe, particularly in Northern countries and the inland waterways of Germany, France, and the Netherlands, environmental regulation and cultural expectations around sustainability are pushing rapid adoption of low-emission and electric propulsion, supported by investments in charging infrastructure and marina electrification.

In Asia-Pacific, rising middle-class wealth and the development of marinas in Thailand, Indonesia, China, and South Korea are unlocking new demand for both entry-level and premium outboards. Australia and New Zealand, long associated with offshore sportfishing and long-range coastal cruising, are increasingly adopting high-horsepower outboards for large center consoles and performance cruisers. Meanwhile, emerging markets in Latin America, the Middle East, and Africa are turning to modern outboards to support tourism, inter-island transport, and fisheries modernization. These regions may still be smaller in volume, but their long-term potential is significant as infrastructure improves and as electric and hybrid systems become more self-contained and resilient.

A second major growth driver is technological innovation. Lightweight alloys, advanced coatings, and sophisticated fuel-injection systems have raised expectations for performance and durability, while the integration of digital control systems has transformed outboards into networked devices capable of real-time diagnostics, over-the-air software updates, and seamless integration with helm electronics. Owners now expect propulsion that is not only powerful and efficient but also deeply connected, intuitive to manage, and compatible with modern navigation suites from companies such as Garmin and Raymarine. Readers following these developments in the technology and design sections of Yacht-Review.com will recognize that propulsion is increasingly the anchor around which the entire onboard digital ecosystem is architected.

Finally, replacement and refit activity is accelerating as older two-stroke engines are retired in favor of cleaner four-stroke and electric options. This is particularly visible in mature markets where environmental regulations and fuel costs are driving owners to upgrade. Service yards and dealers worldwide are seeing robust demand for propulsion conversions, providing new revenue streams and encouraging investments in training and diagnostic capabilities. For business stakeholders who follow industry moves in the business and news pages, this aftermarket shift is as strategically important as new-build sales.

Regional Perspectives: From Mature Hubs to Emerging Frontiers

North America: Digital Integration and High-Horsepower Growth

In North America, encompassing the United States and Canada, the outboard engine market remains the world's largest and one of the most technologically advanced. High disposable income, extensive inland and coastal waterways, and a strong culture of recreational boating underpin a steady demand for both mid-power and high-power engines. Over the 2025-2030 period, the region is witnessing widespread adoption of digital throttle-and-shift systems, integrated helm displays, joystick docking, and multiple-engine installations on larger center consoles and yacht tenders.

Manufacturers such as Mercury Marine, Yamaha Motor Co., Suzuki Motor Corporation, and Honda Marine are leveraging their engineering depth to deliver outboards that combine high output with low emissions, reduced noise, and sophisticated engine management. Mercury Marine, part of Brunswick Corporation, has built a strong position in networked propulsion through its SmartCraft and VesselView platforms, which offer real-time analytics and integration with navigation and entertainment systems. Yamaha emphasizes reliability and global service coverage, a critical factor for long-distance cruising along the U.S. East Coast or throughout the Great Lakes. For North American owners comparing performance and ownership experience in the cruising section of Yacht-Review.com, these digital ecosystems are becoming a decisive differentiator.

Europe: Regulation, Electrification, and Sustainable Innovation

Europe's outboard market is strongly shaped by environmental policy and a long tradition of inland and coastal boating. The European Commission has continued to tighten emissions and noise regulations for marine engines, accelerating the shift toward four-stroke and electric propulsion and prompting manufacturers to invest heavily in cleaner combustion technologies and zero-emission systems. Countries such as Norway, Sweden, Finland, Germany, and the Netherlands are at the forefront of electrification, supported by marina charging networks and public incentives for low-impact boating. Readers can explore broader regulatory context through resources such as the European Environment Agency and related environmental policy briefings.

European yacht builders and technology firms are also experimenting with hybrid propulsion architectures that blend electric outboards with onboard energy generation from solar, fuel cells, or sustainable biofuels. Start-ups from Scandinavia and Central Europe are positioning electric outboards not just as a compliance tool but as an aspirational, premium choice aligned with a broader sustainability ethos. In-depth coverage in Yacht-Review.com's sustainability features shows how these solutions are influencing yacht design, from silent operation in sensitive marine habitats to integrated energy management across the entire vessel.

Asia-Pacific: Fastest-Growing Demand and Manufacturing Partnerships

Asia-Pacific has become the fastest-growing region for outboard propulsion, reflecting demographic changes, infrastructure investment, and the expansion of maritime tourism. Rising middle-class incomes in China, Southeast Asia, and India are supporting new boat ownership, while established markets such as Japan, South Korea, Australia, and New Zealand continue to demand high-performance engines for sportfishing, diving, and offshore cruising. Governments in Thailand, Indonesia, and Malaysia are promoting marina development and yacht tourism, which in turn stimulates demand for both new engines and refits.

Global manufacturers are increasingly forming joint ventures and localized production agreements with Asian partners to reduce costs and better serve domestic markets. This regionalization of manufacturing not only shortens supply chains but also encourages technology transfer and the development of local service networks. For yacht owners and charter operators exploring Asia-Pacific itineraries, as often profiled in our travel and global sections, the availability of skilled service, spare parts, and compatible charging infrastructure is becoming a key planning factor, particularly as electric and hybrid systems gain traction.

Latin America, Middle East, and Africa: Emerging Hubs and Long-Term Potential

Latin America, the Middle East, and Africa collectively represent smaller but rapidly evolving markets with substantial long-term upside. Brazil, Mexico, South Africa, and the United Arab Emirates are developing marine clusters that combine tourism, boatbuilding, and service infrastructure. Island nations in the Caribbean and Indian Ocean, as well as coastal states along the Red Sea and East Africa, are turning to modern outboards to support inter-island transport, diving operations, and fishing cooperatives. As these regions modernize their fleets, there is growing interest in engines that balance reliability and affordability with improved fuel efficiency and lower emissions.

The gradual introduction of electric outboards, supported by solar-based microcharging systems and modular battery packs, holds particular promise for remote communities where fuel logistics are complex and costly. International organizations and development agencies, often referenced through platforms like the World Bank's climate initiatives, are beginning to view clean marine propulsion as part of broader coastal resilience and sustainable development strategies. For the global audience of Yacht-Review.com, these regions not only offer new cruising frontiers but also highlight how propulsion innovation can support local economies and environmental stewardship.

Technological Evolution: From Mechanical Power to Intelligent Propulsion

The most visible dimension of change in outboard engines is technological sophistication. Traditional mechanical systems are being replaced or augmented by digital technologies that enhance efficiency, reliability, and user experience. Electronic fuel injection, variable valve timing, and advanced ignition control have become standard on premium combustion engines, enabling higher torque, smoother acceleration, and lower specific fuel consumption. These systems are increasingly managed by engine control units capable of processing data from multiple sensors and communicating with helm displays, mobile devices, and cloud platforms.

Electric and hybrid propulsion represent the most disruptive technological shift. Advances in lithium-ion and emerging solid-state battery chemistries, along with improved thermal management and power electronics, have significantly increased the power and range capabilities of electric outboards. Companies such as Torqeedo, Evoy, Pure Watercraft, and Vision Marine Technologies are pushing into higher horsepower segments, bringing electric propulsion into applications that were historically dominated by gasoline engines. Owners are attracted by the promise of near-silent operation, minimal vibration, reduced maintenance, and alignment with broader sustainability goals. Those interested in the underlying energy transition can explore broader context through resources such as the International Energy Agency and its analysis of electrification trends.

Hybrid systems, combining combustion engines with electric drives and battery storage, are gaining traction in luxury segments where owners require both extended range and quiet, emission-free operation in sensitive areas. These architectures allow yachts to maneuver and cruise at low speeds on electric power while relying on combustion for longer passages or higher speeds, often with regenerative charging strategies integrated into the overall energy system. Coverage in Yacht-Review.com's design and technology sections increasingly highlights how naval architects and system integrators are recalibrating hull forms, weight distribution, and onboard electrical systems around such hybrid propulsion concepts.

Market Segmentation by Power, Fuel, and Application

Segmentation of the outboard market by power range, fuel type, and application reveals where the most significant shifts are occurring. Low-power engines below 100 horsepower continue to dominate unit volumes, especially in small recreational craft, tenders, and fishing boats. In this segment, the emphasis remains on affordability, ease of maintenance, and robust performance in varied operating conditions. Electric outboards are steadily gaining share here, particularly in inland waterways and lakes with strict noise or emissions regulations.

The mid-power segment between 100 and 300 horsepower is experiencing strong growth, as modern four-stroke engines deliver impressive torque, fuel efficiency, and quiet operation suitable for family cruisers, sport boats, and small yachts. Owners in this category increasingly expect digital throttle-and-shift, integrated helm displays, and compatibility with advanced autopilot and navigation systems. For many readers of Yacht-Review.com, this is the sweet spot where performance, comfort, and manageability intersect.

High-power outboards above 300 horsepower are reshaping vessel design and replacing traditional inboard configurations on larger boats. Quad and even quintuple engine installations now power large center consoles and performance cruisers, offering redundancy, shallow draft, and simplified maintenance compared with inboard diesel systems. This trend is particularly evident in the United States, Australia, and parts of the Mediterranean, where speed and offshore capability are prized. Insights into how these configurations influence cruising behavior and ownership economics are frequently explored in our cruising and lifestyle pages.

Fuel and ignition technologies are also evolving. Electronic fuel injection and digital ignition are now standard on most premium engines, while research into alternative fuels such as hydrogen and advanced biofuels is accelerating. Organizations such as the International Maritime Organization are shaping the regulatory landscape for maritime emissions, encouraging manufacturers to future-proof their product lines with engines that can adapt to lower-carbon fuels. This movement dovetails with the broader sustainability narrative that Yacht-Review.com covers in its sustainability and business reporting.

Competitive Landscape and Strategic Alliances

The competitive environment in outboard propulsion is characterized by a combination of established global players and agile electric-propulsion specialists. Yamaha Motor Co., Mercury Marine, Suzuki Motor Corporation, and Honda Marine together account for a substantial share of the global market, leveraging decades of engineering expertise, extensive dealer networks, and strong brand equity. Each of these companies is investing heavily in cleaner combustion technologies, digital control systems, and integration with helm electronics.

At the same time, electric and hybrid innovators such as Torqeedo, Evoy, AquaWatt, Pure Watercraft, and Vision Marine Technologies are carving out growing niches, particularly in markets and applications where noise and emissions are tightly regulated or where sustainability is a core brand value. As battery costs decline and energy density improves, these companies are moving from niche to mainstream, prompting strategic responses from the incumbents. Many established manufacturers are pursuing partnerships, equity investments, or technology licensing arrangements with electric specialists to accelerate their own electrification strategies.

For yacht builders and dealers featured in the business and news sections of Yacht-Review.com, these alliances are reshaping product roadmaps and customer offerings. Builders are increasingly selecting propulsion partners not only for engine performance but also for software ecosystems, remote diagnostics capabilities, and long-term sustainability roadmaps. The result is a more interconnected value chain in which engine manufacturers, electronics providers, and boatbuilders collaborate from the earliest design stages.

Evolving Owner Expectations and the Experience Imperative

Owner expectations in 2026 are markedly different from those of a decade ago. Whereas horsepower and top speed once dominated purchase decisions, today's buyers place greater emphasis on reliability, quietness, connectivity, and environmental impact. They expect propulsion systems to mirror the intuitive, app-driven experience of modern automobiles, from digital dashboards and predictive maintenance alerts to integrated route planning and fuel efficiency optimization. Many of these expectations are informed by broader technology trends analyzed by organizations such as McKinsey & Company and other strategic advisors to the mobility sector.

Predictive maintenance and remote diagnostics are becoming particularly important for owners who cruise extensively or operate charter fleets. Engine data can now be monitored via mobile applications, enabling early detection of anomalies and reducing unplanned downtime. For families and long-range cruisers who depend on their propulsion systems far from home ports, this data-driven reassurance is a critical element of trust. Readers exploring family-oriented cruising insights in the family section of Yacht-Review.com will recognize how such reliability features directly influence itinerary planning and safety considerations.

Aesthetic and ergonomic integration is another dimension of evolving preferences. Designers and engine manufacturers are collaborating to create outboards that complement hull lines, color schemes, and overall brand identity. Sleeker cowlings, customizable finishes, and compact packaging reflect a view of propulsion as part of the yacht's visual narrative, not merely a functional necessity. This convergence of form and function is particularly evident in the luxury tender segment, where owners demand that performance, silence, and style coexist seamlessly.

Sustainability, Regulation, and the Ethics of Power

Sustainability has moved from a peripheral concern to a central pillar of strategy for the marine industry. Governments across North America, Europe, and Asia are progressively tightening emissions standards for marine engines, targeting carbon dioxide, nitrogen oxides, and particulate matter. In the United States, the Environmental Protection Agency continues to refine regulations for marine spark-ignition engines, while in Europe, evolving directives support zero-emission zones on inland waterways and in urban harbors. These frameworks, coupled with the expectations of environmentally conscious owners, are accelerating the shift toward cleaner propulsion.

Manufacturers are responding not only through product innovation but also by reconfiguring their supply chains and production processes. Recyclable materials, lower-impact coatings, and bio-based lubricants are gaining ground, and some major players are committing to carbon-neutral manufacturing facilities. This broader decarbonization agenda aligns with global initiatives promoted by platforms such as the United Nations Environment Programme, and it resonates strongly with the ethos of many yacht owners who see environmental stewardship as integral to responsible enjoyment of the seas.

For the Yacht-Review.com community, which includes owners, captains, designers, and investors across Europe, North America, Asia, and beyond, sustainability is increasingly a lens through which all aspects of yacht ownership are evaluated. Electric and hybrid outboards not only reduce local emissions and noise but also enable new forms of cruising, such as silent anchoring in marine reserves or low-impact exploration of sensitive coastal ecosystems. Articles in our sustainability and global categories show how these propulsion choices are shaping itineraries from the Norwegian fjords to the islands of Southeast Asia.

Digital Control, AI, and the Future of Navigation

The integration of propulsion with digital control systems, artificial intelligence, and advanced sensors is redefining what it means to command a yacht. Throttle-by-wire, joystick steering, and integrated docking systems have already transformed maneuvering in tight marinas, making large multi-engine installations manageable for smaller crews and family operators. The next phase involves AI-driven optimization, where algorithms analyze sea state, wind, engine load, and route data to adjust performance in real time, balancing speed, comfort, and efficiency.

These capabilities rely on increasingly sophisticated onboard and cloud-based software, as well as high-bandwidth connectivity via 5G and satellite networks. Over-the-air updates allow manufacturers to refine engine control strategies and add new features throughout the product lifecycle, similar to what has become standard in the automotive sector. For technically inclined readers of Yacht-Review.com, this convergence of propulsion and software is a defining theme of the 2025-2030 horizon, and it is reshaping expectations of what a "smart yacht" should deliver.

From a safety perspective, integrated propulsion and navigation systems offer enhanced situational awareness. Engine data, fuel status, weather information, and route planning are unified into a single interface, reducing cognitive load on the helm and enabling better decision-making. As covered in our history features, this represents a significant evolution from the analog gauges and stand-alone instruments that defined previous generations of boating.

Infrastructure, Emerging Markets, and the Globalization of Yachting

Infrastructure development is both a driver and a consequence of the outboard market's evolution. The construction and modernization of marinas, waterfront developments, and service centers across Asia, the Middle East, and Africa are expanding the geographic footprint of yachting. Countries such as Saudi Arabia and the United Arab Emirates are developing world-class marina networks along the Red Sea and Arabian Gulf, designed to attract international superyachts and high-performance recreational craft. In Southeast Asia, new marinas in Thailand, Malaysia, and Indonesia are opening up cruising grounds that were previously accessible only to the most self-sufficient vessels.

In parallel, smaller coastal communities in Africa and Latin America are beginning to adopt more efficient and environmentally responsible outboards for fishing and transport, often supported by international development programs. These trends are chronicled in the global and community sections of Yacht-Review.com, highlighting how propulsion technology can support local livelihoods while reducing environmental impact. As electric and hybrid outboards become more robust and affordable, their potential to reduce fuel dependency and improve air and water quality in these regions becomes increasingly compelling.

For private owners and charter operators, the spread of reliable service networks and, in the case of electric propulsion, charging infrastructure, is a prerequisite for confident cruising. The expansion of such infrastructure is therefore both a commercial opportunity and a strategic necessity for manufacturers and marina developers alike.

Looking Ahead to 2030: Experience, Trust, and Strategic Choices

By 2030, outboard engines are expected to embody a synthesis of mechanical robustness, digital intelligence, and environmental compatibility. Most new yachts and high-end recreational boats will feature propulsion systems that are deeply integrated with onboard electronics, capable of remote diagnostics, and optimized for lower emissions and noise. Electric and hybrid outboards will account for a substantial share of new installations, particularly in premium, charter, and regulation-sensitive segments, while advanced four-stroke engines will continue to serve applications where energy density and range remain decisive.

For the audience of Yacht-Review.com, spanning owners, captains, designers, shipyards, and investors across the United States, Europe, Asia, and beyond, the next five years demand informed, strategic choices. Propulsion decisions will influence not only performance and running costs but also access to certain cruising grounds, resale values, and alignment with evolving environmental expectations. The site's editorial focus on experience, expertise, authoritativeness, and trustworthiness is designed to support those decisions, whether readers are comparing engine options in the reviews section, exploring new technologies in technology, or assessing long-term business implications in business.

Ultimately, the transformation of the outboard engine from a simple mechanical device into a sophisticated, connected, and increasingly clean propulsion system encapsulates the broader evolution of yachting itself. It reflects a shift from raw power toward intelligent, responsible, and experience-driven boating. As this quiet revolution continues through 2030, Yacht-Review.com will remain committed to documenting its progress, providing the global yachting community with the insight and context needed to navigate this new era with confidence.